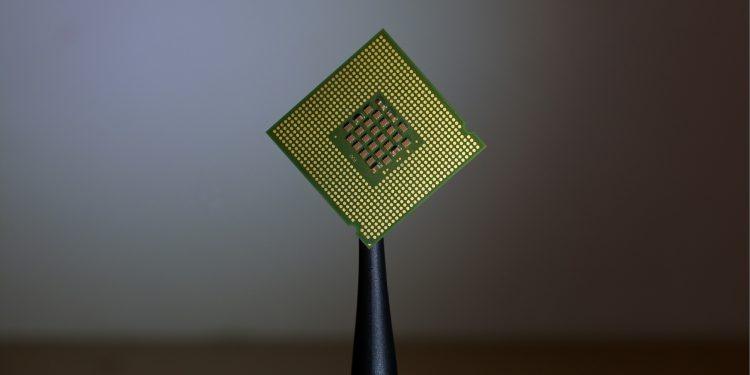

Artificial intelligence (AI) was mostly a story of GPUs in 2025 – but analysts now say the spotlight is shifting.

According to T. Rowe Price analyst Rahul Ghosh, the semiconductor trade in 2026 is tilting toward CPUs, as inferencing demand reshapes the supply chain. “It’s CPUs this year versus GPUs last year,” he told CNBC in an interview today.

The pivot underscores how investors must recalibrate their strategies in the fast-evolving AI race.

Why CPUs are the hotter bet in 2026

The AI boom has long been synonymous with GPUs for their central role in training large language models (LLMs).

But inferencing – the process of running those models at scale – is now increasingly CPU-heavy. “That’s where the shortage is really going to set up,” Ghosh argued on “Squawk Box Asia”.

CPUs are better suited for a diverse set of workloads, offering flexibility and efficiency as enterprises deploy artificial intelligence across industries.

With shortages looming, CPUs could emerge as the next bottleneck in 2026 – and, therefore, the next profit centre. The narrative has shifted from training to deployment, and CPUs are at the heart of it.

CPUs as the backbone of inferencing demand

What makes CPUs particularly compelling is their role in scaling AI beyond the lab.

Inferencing requires chips that can handle millions of queries quickly and “cost-effectively” – and CPUs are proving indispensable.

As businesses roll out AI tools in real-world settings, “the movement is now more towards what’s happening on the CPUs,” Ghosh explained in the CNBC interview.

Unlike GPUs, which excel at training, CPUs tend to thrive in environments where adaptability and integration matter most.

From cloud providers to enterprise servers, CPUs are becoming the backbone of AI adoption.

For investors, this means the CPU trade is not just cyclical – it’s structural, tied to the expansion of AI into everyday business.

Does this make Intel stock a great pick for 2026?

The short answer – “yes”. Intel, long seen as lagging in the GPU arms race, suddenly looks well-positioned as CPUs regain centre stage.

Its dominance in server processors and renewed push into AI-ready chips align perfectly with the trend.

Intel’s recently launched Core Ultra Series 3 “Panther Lake” processors – its first built on the 18A node – strengthen the case for owning INTC stock in 2026.

The semiconductor behemoth is scheduled to report its Q4 earnings on the coming Thursday – and options traders believe the release will prove a near-term catalyst that drives Intel shares higher.

While the chip stock no longer pays a dividend, Wall Street analysts’ consensus “hold” rating on it comes with price targets going as high as $60, according to Barchart – indicating potential upside of about 27% from here.

In short, the AI play may not be about chasing the flashiest chips this year, but betting on the steady giants.

The post CPUs dubbed a better pick than GPUs as AI play for 2026 appeared first on Invezz