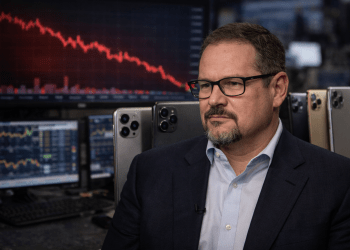

Qualcomm (NASDAQ: QCOM) shares opened about 11% down on Feb. 5 after the semiconductor giant issued cautious guidance for its fiscal Q2 that overshadowed its record-breaking performance in the holiday quarter.

In its earnings release, the company based out of San Diego, CA, cited the global memory shortage that’s forcing smartphone manufacturers to scale back production for its muted outlook.

However, it’s reasonable to assume that QCOM’s guidance will ultimately prove too conservative since its diversified portfolio and premium focus position it well to weather supply constraints.

In fact, the post-earnings sell-off may actually be an “exciting opportunity” for long-term investors to invest in Qualcomm stock that’s now down more than 25% versus its year-to-date high.

Why memory shortage may not be ‘that’ big a concern for QCOM shares

QCOM stock’s post-earnings plunge may be “overdone” given the market is treating the memory shortage as a demand problem, when it’s actually a logistical delay only.

On the earnings call, the company’s chief executive, Cristiano Amon, agreed that consumer demand for high-end phones remains robust.

The “weakness” is simply OEMs being unable to finish building phones they have already planned. This is “deferred” revenue – not lost sales.

Additionally, the shortage hits low-end, low-margin budget phones the hardest because they can’t absorb the DRAM price hikes – but Qualcomm’s bread and butter is the premium tier (Snapdragon 8 Series).

High-end consumers are less price-sensitive, and OEMs will prioritise their limited memory supply for these high-margin flagship devices where QCOM makes its biggest profits.

In short, while memory shortage sure is a headwind, it’s not like Qualcomm is entirely unequipped to weather that storm.

How diversified portfolio makes Qualcomm stock worth owning on the dip

What’s also worth mentioning is that even if memory shortages cap handset shipments through the remainder of 2026, QCOM’s diversified portfolio positions its stock well to remain resilient.

Amid smartphone weakness, Qualcomm will continue reallocating resources aggressively toward its Automotive and PC (Snapdragon X) divisions – which rely on different supply chains and are currently growing at record rates.

The strategy is already yielding results: Automotive revenue reached a record “$1.1 billion” in the company’s first quarter, growing about 15% on a year-over-year basis.

On Thursday, the management even guided for Automotive growth to surpass 35% in fiscal Q2 – reinforcing that this segment offers higher long-term visibility.

By leveraging the “Snapdragon Digital Chassis” for partners like Volkswagen and Toyota, and scaling the Snapdragon X2 Plus for a new wave of 150+ artificial intelligence PCs, QCOM is transforming into a diversified processing giant.

This shift effectively “de-risks” the portfolio – turning a temporary smartphone supply cap into a catalyst for its more profitable, high-growth “beyond-mobile” future.

All in all, it’s no longer just a smartphone company; it’s an Edge AI and computing powerhouse, and that makes Qualcomm shares worth buying at the current toned down levels.

The post Qualcomm stock: why the ‘memory problem’ may be overstated appeared first on Invezz